It appears that some employees' EA Forms show a negative amount or it doesn't add up to the payslip amounts for the whole year.

The Payroll Figures Take On (PFTO) is a tool to amend the EA Form. To learn more about PFTO, navigate to Payroll Figures Take On (PFTO) & Previous Employment Figures Take On (PEFTO): Knowledge Base (freshdesk.com)

You can refer to YTD Employee Statistic Report to check back on the payroll figures that have been recorded for a specific employee

Here this article will discuss how to use the YTD Employee Statistic report as a reference in correcting the EA Form manually via the Payroll Figures Take On tool.

Part 1: Preparing the YTD Employee Statistic Report

Step 1

Generate YTD Employee Statistic report by reading our other article on Generating YTD Payroll Reports: Knowledge Base (freshdesk.com)

Step 2

The screen will now appear as per the screenshot below. Click on the triple dots vertical icon, and on Export Excel.

Step 3

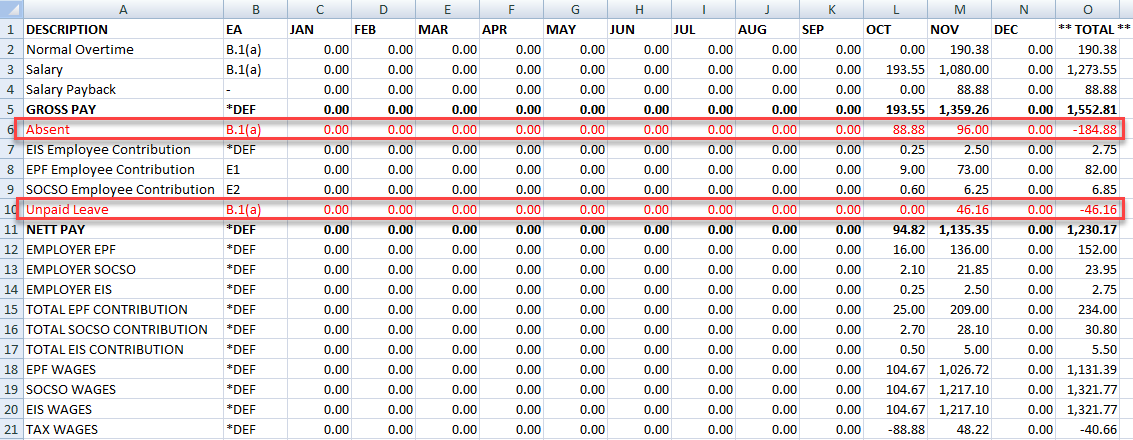

The data will now appear in Excel as below. Leave the report aside first. We will come back to this file later.

Part 2: Preparing the Payroll Item listing report

Step 1

Read our other article on How to export payroll items into Excel format? : Knowledge Base (freshdesk.com) to refer to how to download the payroll item listing report.

Step 2

The Payroll Items report shall now appear like the screenshot below.

Refer to the EA Form column as shown in the red box.

Part 3: Determine the payroll items' EA category as in the YTD Employee Statistic report

Step 1

On the downloaded YTD Employee Statistic Excel report, prepare a column between the Description and January data.

Refer to Column B highlighted in the screenshot below.

Now, for each payroll item, assign the settings accordingly by comparing it to the Payroll Item report downloaded in Part 2 earlier.

Remember to go through it individually as some items were not showing the EA Form category by default.

For example, for Salary, as shown in the B3 cell, this payroll item is not configured under Setting, and will not appear in the Payroll Item report because it is by default available to process without us having had to create a Payroll Item in Settings.

- Salary - B1(a)

- EPF Employee Contribution - E1

- SOCSO Employee Contribution - E2

Step 2

Next, you may need to differentiate the deduction payroll items, if, there are any payroll items from both Earnings and Deductions/Unpaid Leave types sharing the same EA Category.

For example, both Absent and Unpaid Leave are categorized under B1(a), similar to Normal Overtime and Salary.

By default, the total on Column O will show a positive figure.

Thus, change the deductions to negative. For example, Absent was previously shown as RM184.88. I'm changing it to -RM184.88.

Similar goes for Unpaid Leave. This is for our convenience to sum the total up easily later in our Pivot Table analysis.

Step 3

Select the whole table and then click on the PivotTable button.

Step 4

On your Pivot Table, input the fields from the data to the layout as below:

- EA - column

- Description - row

- Sum of Total - values

*Notice on Column D for B1(a), the data minus out the deduction items accordingly. This is the reason why Step 2 was required earlier.

Step 5

From the YTD report analysis, now, you can determine what was processed throughout the whole year and what was processed under B1(a), B1(b), and so on.

Some payroll items may not appear anywhere. For this case, you will need to refer back what was the setting for that payroll item on that particular month.

In the example below, I have for Section B EA Form, three categories, B1(a), B1(b), and B1(c).

Part 4: Comparing the YTD Employee Statistic Analysis with EA Form

Step 1

Generate one of the employee's EA Forms that you would like to check the payroll figures for. Navigate to our other article on Individual & Bulk EA Form : Knowledge Base (freshdesk.com)

Step 2

With the EA Form, compare each line with your analysis outcome.

Notice in the sample below, B1(a) for both the EA Form and analysis result is RM25,349.52. Similarly, all others are tallied.

Step 3

In the case where it is not tallied, enter the amount difference in the Payroll Figures Take On. Please refer to the example below.

Example :

Analysis Result B1(a) amount is correct = RM60,000.00

EA Form Amount B1(a) = RM5,000.00

Analysis Result B1(a) - EA Form Amount B1(a) = Amount Difference

RM60,000.00 - RM5,000.00 = RM55,000.00

Enter the RM55,000.00 missing amount to Payroll Figures Take On under line B1(a).

Continue the similar process for other lines, for example, B1(b) or B1(c), if required.

You may also want to refer back to our previous article can I manually amend the EA form without reprocessing past payroll cycles

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article