Step 1

On the left menu bar, navigate to Settings(a) > Payroll(b) > Payroll Items(c).

Step 2

On the left side, you will able to see different types of payroll items (Earnings, Deductions, Overtime, Unpaid Leave, Bonus, and Advance).

Select either of these and click on Add New(d) to add a new payroll item.

Step 3

Kindly see the functionality of each feature when creating a new shift as listed down below:

i) Name - The name of the new payroll item that you would like to have

ii) Label - The label of the new payroll item

iii) Category - You can add labels for the category to category few payroll items to be reflected in the payroll reports

iv) Default Amount - Insert the amount that will be reflected by default when you add this payroll item

v) Rounding - How you wanted to round the default amount to be

vi) Rounding Value to - You may choose 1, 5, and up to 10 cents to round the figures

vii) Prorate Deduction for Employee which is - Choose if this payroll item will be prorated for New Join / Resigned / Unpaid Leave

viii) Add to ORP Calculation - whether you wanted to include the payroll item when calculating unpaid leave/overtime or paid in lieu.

ix) Prorate Deduction Based on - Choose how the payroll item will be prorated

- Calendar Month - Prorate based on the actual number of days per month.

- Custom - Calculation will be divided based on the number of days you have set here.

- Working Day - Prorate based on the number of working days of this employee's schedule.

x) Include in EPF Monthly Wage - This toggle is to decide your monthly wage that will determine if employer EPF contribution is 12 or 13%. If your monthly wage exceeds 5k (excludes bonus amount), employer contribution is 12%.

To calculate the total contribution amount is actually based on EPF base amount.

To understand more, refer to What does "Include in EPF Wage" mean?Basic Salary (4500) + Allowances ( 300 ) = RM 4800 ( Total Wages below RM 5000 )

EPF Base = Basic Salry (4500) + Allowance (300) + Bonus (5000) = RM 9800.

In this case, the employer contribution will be calculated as 13%.

EPF Contribution = RM9800 *13%

xi) Include as Fixed Income Tax Base - The payroll item will be included as a fixed income tax base to calculate the PCB.

You may see it under Fixed Income Tax Base in the payroll review as an example image below,

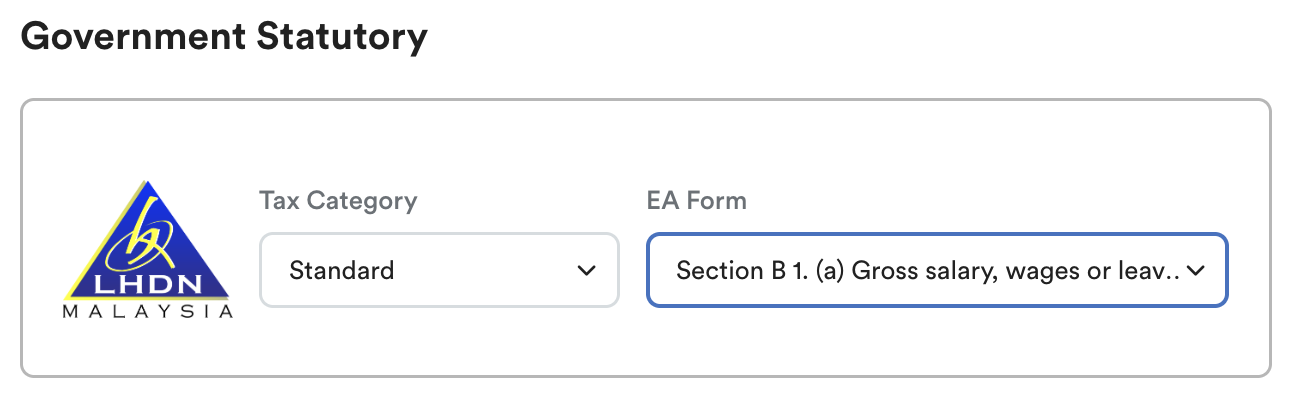

To understand fixed and additional income tax, refer to Fixed and Additional Income Tax Basexii) Government Statutory - You will need to determine if this payroll item is subjected to income tax, and under which section will it be calculated on EA Form (e.g. Benefit in-kind)

xiii) Statutory Flagging - Tick means this payroll item will be included in the statutory base when calculating the contribution example EPF base, SOCSO base, EIS base.

Example :

Step 4

After creating your payroll item, click Save to record your changes

We hope this explanation clarifies the matter. If you require further assistance, please don't hesitate to contact our support team.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article